It most often means that your business is very efficient at collecting the money it’s owed. That’s also usually coupled with the fact that you have quality customers who pay on time. These on-time payments are significant because they improve your business’s cash flow and open up credit lines for customers to make additional purchases. Congratulations, you now know how to calculate the accounts receivable turnover ratio. The accounts receivable turnover ratio is comprised of net credit sales and accounts receivable.

The higher the number of days it takes for customers to pay their bills results in a lower receivable turnover ratio. Maria’s receivables turnover ratio is 6 times for the year 2023 which means it, on average, has collected its receivables 6 times during the year. To analyze how efficient the company has been in collecting its receivables during this period, it can compare this ratio with its competing entities as well as the past years’ ratio of its own. Another example is to compare a single company’s accounts receivable turnover ratio over time. A company may track its accounts receivable turnover ratio every 30 days or at the end of each quarter.

This metric helps companies assess their credit policy as well as its process for collecting debts from customers. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. In other words, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year. The numerator of the accounts receivable turnover ratio is net credit sales, the amount of revenue earned by a company paid via credit. This figure does not include cash sales as cash sales do not incur accounts receivable activity.

Formula For Accounts Receivable Turnover Ratio

Read about features, pricing, and more to make the best decision for your company. The portion of A/R determined to no longer be collectible – i.e. “bad debt” – is left unfulfilled and is a monetary loss incurred by the company. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

The accounts receivables turnover ratio is also known as the receivables turnover ratio, or just the turnover ratio for shortness. Like other financial ratios, the accounts receivable turnover ratio is most useful when compared across time periods or different companies. For example, a company may compare the receivables turnover ratios of companies that operate within the same industry.

This is a great way to increase this ratio as it motivates the clientele of yours to pay faster and be punctual for all future transactions resulting in increased revenue generation. But with an effective budget, you can prepare for the dips by making the most of your peaks. When you know where your business stands, you can invest your time in solving the problem—or getting even better. Since industries can differ from each other rather significantly, Alpha Lumber should only compare itself to other lumber companies.

Why You Can Trust Finance Strategists

This means that Bill collects his receivables about 3.3 times a year or once every 110 days. In other words, when Bill makes a credit sale, it will take him 110 days starting a small business to collect the cash from that sale. It measures the value of a company’s sales or revenues relative to the value of its assets and indicates how efficiently a company uses its assets to generate revenue. A low asset turnover ratio indicates that the company is using its assets inefficiently to generate sales.

Example of accounts receivable turnover ratio

The accounts receivable turnover ratio is an important assumption for driving a balance sheet forecast and making accurate financial predictions. As you can see above, what determines a “good” accounts receivable turnover ratio depends on a variety of factors. Holding the reins too tight can have a negative impact on business, whereas being too lackadaisical about collections leads to limited cash flow. With certain types of business, such as any that operate primarily with cash sales, high receivables turnover ratio may not necessarily point to business health. You may simply end up with a high ratio because the small percentage of your customers you extend credit to are good at paying on time.

Businesses that complete most of their purchases by extending credit to customers tend to use accrual accounting, as it accounts for earned income that has not yet been paid. Cash basis accounting, on the other hand, simply tracks money when it’s actually paid or spent on expenses. Most businesses operate on credit, which means they deliver the goods or services upfront, invoice the customer, and give them a set amount of time to pay. Businesses use an account in their books known as “accounts receivable” to keep track of all the money their customers owe.

Accounts Receivable Turnover Calculator

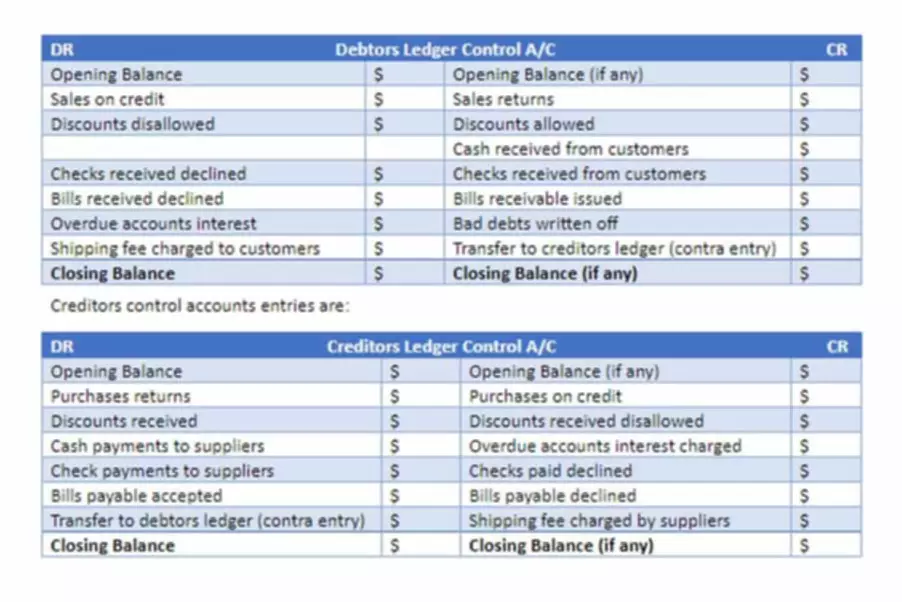

Net credit sales also incorporates sales discounts or returns from customers and is calculated as gross credit sales less these residual reductions. Like some other activity ratios, receivables turnover ratio is expressed in times like 5 times per quarter or 12 times per year etc. Receivables turnover ratio (also known as debtors turnover ratio) is an activity ratio which measures how many times, on average, an entity collects its trade receivables during a selected period of time.

- It is much like the inventory turnover ratio which measures how fast the inventory is moving in a business.

- It can also indicate that the company’s customers are of high quality and/or it runs on a cash basis.

- Then, they should identify and discuss any additional adjustments to those areas that may help the business receive invoice payments even more quickly (without pushing customers away, of course).

- It most often means that your business is very efficient at collecting the money it’s owed.

- The AR balance is based on the average number of days in which revenue is received.

- This is where poor AR management can also affect your accounts payable functions.

How to Calculate Accounts Receivable Turnover Ratio (Step by Step)

Ultimately, the time value of money principle states that the longer a company takes to collect on its credit sales, the more money it effectively accounting receipt loses (i.e. the less valuable sales are). Therefore, a declining AR turnover ratio is seen as detrimental to a company’s financial well-being. A company’s accounts receivable turnover ratio is most often used to quantify how well it can manage extended credit.

However, if credit policies are too tight, they may struggle during any economic downturn, or if competition accepts more insurance and/or has deep discounts. Every business sells a product and/or service that must be invoiced and collected on, according to the terms set forth in the sale. There’s a right way and a wrong way to do it and the more time spent as a “lender”, the more likely you are to incur bad debt. With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business. Liberal credit policies may initially be attractive because they seem like they’ll help establish goodwill and attract new customers.

Then we add them together and divide by two, giving us $35,000 as the average accounts receivable. Since we already have our net credit sales ($400,000), we can skip straight to the second step—identifying the average accounts receivable. You can use this average collection period information to compare your company’s receivables turnover time with that of other companies in your industry. If you have some efficient clients who are always on time with their payments, reward them by offering some discounts which will help attract more business without affecting your receivable turnover ratio. Since it also helps companies assess their credit policy and process for collecting debts, this metric is often used by financial analysts or investors to measure the liquidity of a certain business.