Content

This will give you an idea of how crypto works and what its intended use is. In the case of CFDs, your losses could exceed your initial deposit. When trading, it’s important to always take steps to manage your risk. To get a better idea of the costs of trading, consider opening a demo account.

- Those who invested in, or mined, Bitcoin early are sitting on small fortunes, and the concept is becoming mainstream.

- Take a view across our full range, top or emerging cryptocurrencies with a single trade.

- ACH deposit is typically your cheapest option to fund your account –– it’s free on most platforms.

- Cryptocurrency wallets are tools that allow you to store and send crypto coins back and forth.

- While investors might focus on ‘hodling’, or holding, a cryptocurrency for a long time before selling, a spot cryptocurrency trader will focus on short-term transactions.

- If the CFD is for $10 per point, and the underlying cryptocurrency price moves 10 points, your profit or loss – excluding costs – will be $100 per contract.

- Andrew Munro was the global cryptocurrency editor at Finder, covering all aspects of cryptocurrency and the blockchain.

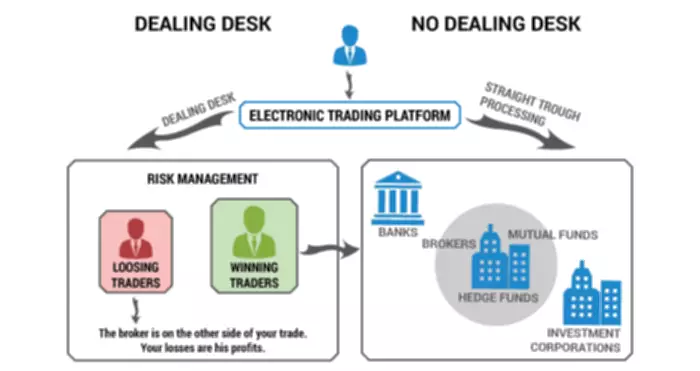

When you’ve chosen the wallets you’d like to use, you are all set and ready to start investing. Upon registration, the system will automatically pair the beginner with a regulated broker. The broker works closely with the trading platform and helps in executing trade transactions.

What Are Inflationary & Deflationary Cryptocurrencies?

Alternatively, open the market’s deal ticket and take the opposite position to one you have open – for example, if you bought CFDs to open, you’d now sell, and vice versa. Bitcoin was the first cryptocurrency, launched in January 2009 by an anonymous developer known by the pseudonym Satoshi Nakamoto. It remains the largest cryptocurrency by market value as of August 2022.

This type of cryptocurrency trading involves the holding of assets for a day. Day Trading is also known as “intraday trading,” where traders enter and exit the position within the same day. In this type of trading, you need to consider basic technical analysis using technical indicators that can help you determine current market conditions and identify the trends.

Finally, don’t overlook the security of any exchange or broker you’re using. You may own the assets legally, but someone still has to secure them, and their security needs to be tight. If they don’t think their cryptocurrency is properly secured, some traders choose to invest in a crypto wallet to hold their coins offline so they’re inaccessible to hackers or others. There are a ton of options when it comes to cryptocurrency brokerages.

Other ways to invest in cryptocurrency

If you are considering applying for a personal loan, just follow these 3 simple steps. Governments around the world are scrambling to create regulatory frameworks https://xcritical.com/ for cryptocurrency. In the United States, the legal classification of cryptocurrency as securities, commodities, currency, or property remains somewhat ambiguous.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. We’ve grouped different cryptocurrencies together in order to create three new crypto baskets, allowing you to trade on multiple cryptos with a single position. Get exposure to volatility on favourites like bitcoin and ethereum, as well as alt coins like polygon with spreads from as low as 0.65 points. Take a view across our full range, top or emerging cryptocurrencies with a single trade. You just need to choose two currencies, one available on your account balance and one you want to receive.

Trading can be defined as the economical concept of buying and selling assets. The assets can be goods and services which are being exchanged between the trading parties. Here we are talking about the financial markets where trading of financial instruments takes place. These can be stocks, currency, cryptocurrency, margin products, etc.

Best online brokers for buying and selling cryptocurrency in December 2022

By performing various statistical calculations on historical price data, you attempt to uncover trends in the market. Technical trading is based on the belief that past prices have some effect on what future prices will be. In this article, we’ll unpack the details of how to day trade crypto and take a look at some of the most effective day trading strategies.

We unpack how they work, what makes them different and compare exchanges that let you trade them. Market and stop-limit are the basic order types you’ll find on almost all exchanges, while OCO is a bit less common. Different exchanges will sometimes have additional order types or slightly different rules about how they can be placed. If you’re looking to buy Bitcoin, pay particular attention to the fees that you’re paying. Here are other key things to watch out for as you’re buying Bitcoin.

Trading Crypto for Short-Term Profit

The Instant Sell option is available on the Buy/Sell menu and allows you to convert your digital funds into real ones in a matter of seconds. Complete the identity verification process to secure your account and transactions. ViewsFounder Interviews Read our interviews with inspiring tech company founders. Find out what they have learned and the mistakes they have made along the way. Submit the required documentation and provide your best possible application. Blockchain Council is an authoritative group of subject experts and enthusiasts who evangelize blockchain research and development, use cases and products and knowledge for a better world.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

Because automated trading can provide you with a conservative, neutral, or aggressive method, you can make money quickly, hold your coins or diversify your portfolio. Many crypto traders allocate a portion of their capital to smaller altcoins. Although cryptocurrency exchange small mid-market cap cryptos are riskier than large-market cap cryptos, they offer higher upside potential. Many small altcoins have risen over 1,000% in a matter of months, making them attractive investments for risk-tolerant investors.

It is usually advisable to store your purchased coins in a crypto wallet. On top of that, there are various other factors that you need to put under consideration to ensure you select the best bitcoin exchange for day trading. These factors include authenticity and security, funding methods supported, the number of supported cryptos, fees and commissions, and the user experience. Therefore, it is vital to balance all these considerations before selecting an exchange to ensure a smooth trading experience. For beginners, it’s imperative to follow the proper steps for cryptocurrency trading.

Fully regulated by the FCA, eToro is one of the leading crypto trading platforms in the UK. Finally, trading fees can be quite high, especially for strategies that employ a very high frequency of transactions. It is important to understand the costs of actually using a trading platform before investing in it. Many fortunes have been made in cryptocurrency, but it is important to always keep in mind that many, many more have been lost. The flip side of unprecedented price surges of several hundred percent is sudden drops. The very high volatility of crypto prices is a double-edged sword, and you need to keep this in mind.

Start Your Crypto Exchange

A trader must know all the ins and outs of the market and bitcoin or any other cryptocurrency to become a successful day trader. Usually, the idea is to purchase a cryptocurrency whose price is likely to rise over the next few hours and then sell it to earn profit. Although this might seem easy to beginners, cryptocurrency trading is demanding and risky.

How to start trade for beginners

Andrew has a Bachelor of Arts from the University of New South Wales. To lay out this plan, they could set up a series of stop-limit orders. The basic principle of reading charts and creating trading plans is to look for patterns in previous price movements and then use those to try and predict future movements. Instantly purchase a handful of leading cryptocurrencies with the SoFi app, which also insures your coins against potential hacks or theft. Place a buy or sell order at the current market price to execute your trade immediately. It’s important to manage risk, but that will come at an emotional cost.

Step 4: Exchange your cryptocurrency

Fast execution, exclusive insights and accurate signals are vital to your success as a cryptocurrency trader. Our award-winning trading platform was built with the successful trader in mind. Our liquid order books allow high-speed order execution even for huge-amount trades. Additionally, we regularly evaluate and improve the performance of the currency pairs presented on our marketplace.

Pros & Cons of Trade Crypto

These cryptos move more predictably than smaller altcoins, so trading with technical indicators can be easier. First, you can buy and sell actual crypto coins on an exchange. In this instance, you’d need to pay the full value of the coins upfront, in addition to opening an account on an exchange and creating a wallet for the coins. But, as positions on ether CFDs can be opened with a margin deposit of 50%, you’ll only need to deposit $15,020.

The first cryptocurrency, bitcoin remains the world’s leading cryptocurrency by market capitalisation or value. It is a global peer-to-peer digital payment system that allows parties to transact directly with each other with no need for an intermediary such as a bank. Bitcoin is often referred to as the digital alternative to fiat currencies and gold, but regulators argue it is significantly riskier and cannot be compared. As there are lots of exchanges, investors have to transfer funds between them somehow and also have a place to store their assets.